What We Do

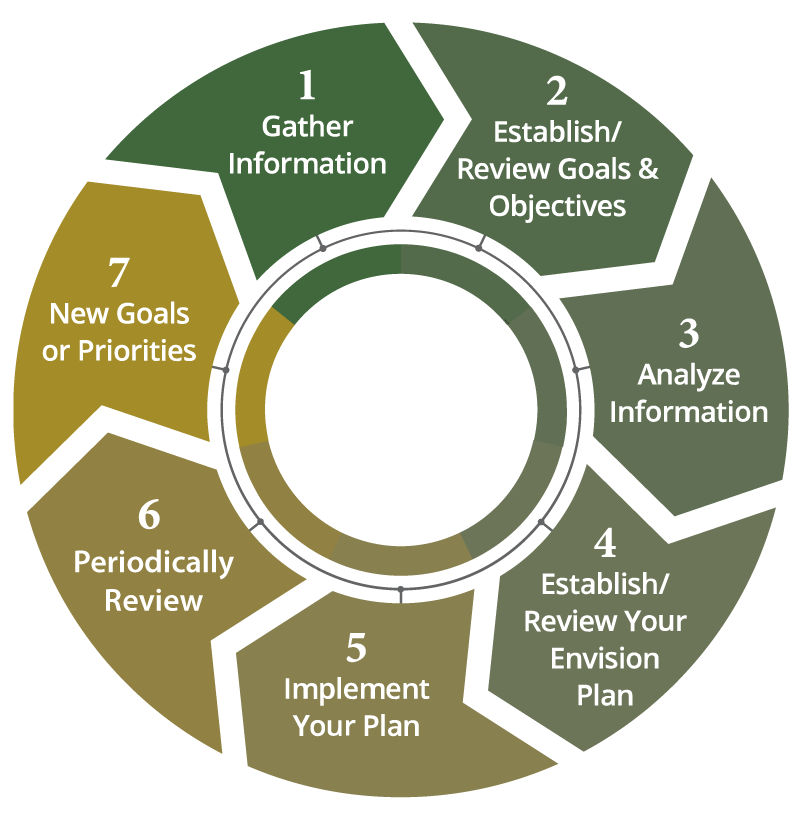

Our Investment Process

At Green Fairways Wealth Management, our investment process is built upon seven key steps that afford a greater understanding of each client’s individual goals and needs. By taking the time to listen to our client’s goals, interests and passions as well as the things that may keep them up at night, our team can craft a highly customized investment management strategy designed for their unique needs and priorities. We implement the investment plan, meet with you as needed to adjust the plan, and make tailored alterations as needed with life events.

- Gather Information

- Establish/Review Goals and Objectives

- Analyze Information

- Establish/Review your envision plan

- Implement your plan

- Periodically review

- New goals or priorities

Our Service Model

We serve individuals and businesses in all areas of investment planning, including:

Retirement Planning

Help making the most of your employer-sponsored retirement plans and IRAs. Determining how much you need to retire comfortably. Help managing assets before and during retirement.

Tax Management

Developing tax-efficient investment strategies by looking for ways to help reduce your current and future tax burden. Referring you to qualified tax specialists.

Estate Planning Strategies

We use a team approach to coordinate estate planning strategies with you and your attorney.

Education Funding

Recommending investment and accumulation strategies to help you pay for your children's education.

Investment Planning

Determining your asset-allocation needs. Helping you understand your risk tolerance. Recommending the appropriate investment vehicles to help you pursue your goals.

Risk Management Strategies

Reviewing existing insurance policies. Finding the best policy for your situation.

*Neither Stifel nor our affiliates provide legal or tax advice. You should consult with your legal and tax advisors regarding your particular situation.